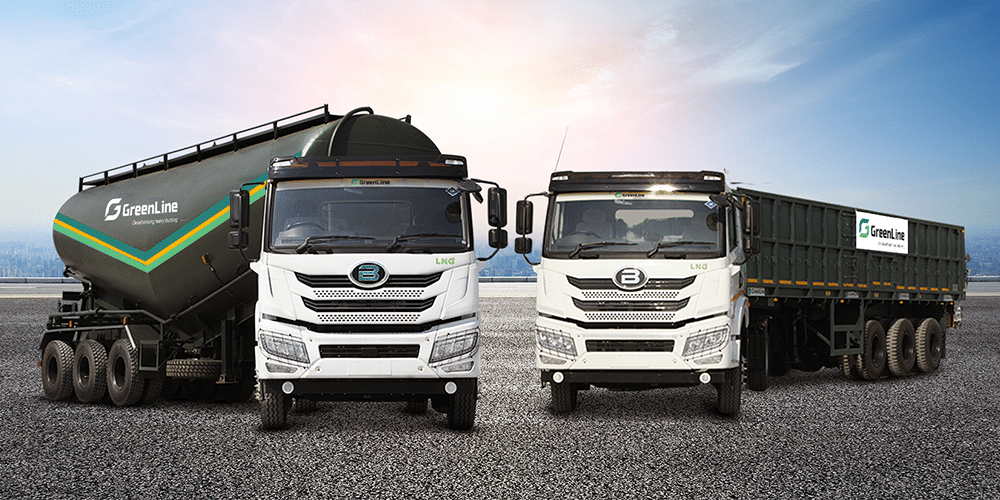

India’s Greenline plans to deploy 1,650 LNG trucks by March 2024: INTERVIEW

Indian logistics company GreenLine plans to deploy 1,650 LNG trucks by March 2024, at an investment of about 14bn rupees ($170mn), Anand Mimani, CEO of GreenLine tells Gas Pathways.

Currently, GreenLine has an operational fleet of 40 LNG-powered trucks across India. We are targeting to deploy 1,650 LNG trucks by March 2024, at an investment of 14bn rupees. By March 2026 we plan to have an operational fleet of 10,000 LNG trucks, at a total investment of 85bn rupees

Anand Mimani, CEO OF GreenLine

Mumbai-based GreenLine has collaborated with multiple companies to create an integrated ecosystem that enables it to be the first and only company to deliver LNG heavy trucking in India.

“LNG refuelling capability is key to our ability to operationalise priority routes of our customers. We achieve this through our agreements with various LNG refuelling network operators such as B-LNG, LNG Express, Ultra Gas & Energy, etc. GreenLine’s LNG off-take assurances enable these companies to further expand their respective networks of LNG refueling stations,” Mimani says.

GreenLine has teamed with Blue Energy Motors, India’s first LNG heavy commercial vehicle manufacturer. Mimani says that this partnership assures the company access to LNG trucks for scaling up deployment of its fleet across multiple customers. GreenLine’s entire fleet of LNG-powered trucks is fully company-owned.

Serving a variety of customers

GreenLine services customers in a variety of industries. It has signed up companies such as UltraTech Cement, JK Lakshmi Cement and Dalmia Cement, to name a few. It is looking to expand its footprint further.

“Our proposition of decarbonising heavy trucking has received a tremendous positive response from ESG-centric corporates that are focused on their net-zero goals. These corporates have been looking for low-emission alternatives for their road logistics, and have wholeheartedly appreciated GreenLine’s offerings,” Mimani says.

“We are sector agnostic as our proposition benefits all sectors where heavy road logistics plays a prominent role. Sectors such as cement, steel, metals, mining, express cargo, containers, chemicals and gases are all priority users from the perspective of decarbonisation of heavy trucking,” he adds.

Mimani says that biggest advantage of switching from diesel to LNG-powered trucks is the significant reduction in toxic emissions.

“Another key advantage of the Blue Energy Motors’ LNG trucks deployed by GreenLine is the range of about 1,400 km on a single tank fill, allowing for longer uninterrupted runs. Furthermore, these LNG trucks have up to 30% lesser noise levels,” he adds.

Huge growth potential for LNG trucking in India

GreenLine sees high demand potential for LNG-powered trucks in the Indian heavy trucking space over the next 10 – 15 years, given LNG is currently the cleanest commercially viable alternative to diesel for heavy duty trucks. The company believes LNG trucking can enable immediate emission reduction from heavy trucking. Mimani argues that the government has a key role to play in creating an enabling environment for adoption of LNG-powered trucking.

He says that the government can facilitate the growth in LNG trucking by cutting goods and services tax (GST) on LNG-powered trucks. LNG trucks are subject to a high GST rate compared with diesel trucks which increases the final cost of LNG trucks and is a deterrent for any fleet operator.

The state can offer incentives and/or tax subsidy on purchase of LNG-powered trucks. “The higher capital outlay for LNG-powered trucks needs to be softened through an incentive/ tax subsidy framework to bring some semblance of parity on capex with diesel trucks and facilitate a shorter payback cycle,” he adds.

The government can also provide incentives for LNG refueling infra development and refuelling stations are essential to the development of LNG trucking as tax benefits can compensate for the low volumes in the initial years.

“A comprehensive LNG policy framework is the need of the hour to drive the growth of LNG trucking in India,” Mimani says.

The lack of LNG dispensing infrastructure had held back widespread deployment of LNG-powered trucks in India till date, and poses a major challenge to the growth of this industry.

In order to overcome this challenge, and to catalyse widespread adoption of LNG-powered trucking in India, GreenLine has taken the initiative of collaborating with multiple entities in LNG refuelling network development.

“Alignment with GreenLine’s footprint ensures committed off-take of LNG for the infra companies and supports setting up of more such LNG dispensing stations,” Mimani says. “With the focus on covering key trucking routes, we expect adequate coverage of the Golden Quadrilateral, North-South Highway and East-West Highway over the coming 12 months. LNG stations are already operational in Vadodara, Nagpur, and Wani, with many more under development across the country.”

GreenLine’s growing virtual pipeline business

GreenLine began operations as a virtual pipeline company, delivering natural gas, in liquefied (LNG) and compressed (CNG) forms, to industries in the off-gas-grid locations. This access to natural gas, the cleanest fossil fuel, enables industries to switch from conventional polluting fuels such as coal and furnace oil and significantly reduces their toxic emissions. The company currently operate the largest privately owned fleet of LNG tanker trucks in India.

GreenLine boasts of multiple customers across sectors as its virtual pipeline clients. Some of its customers include Tata Steel, Shell, AG&P, LNG Express, B-LNG, MNG, Haryana City Gas, P&G, Saint Gobain, Kajaria Tiles, and Haldyn Heinz, among others.